English | ASIN: B0BJ7S8DT4 | 2022 | 14 hours and 5 minutes | MP3 | M4B | 387 MB

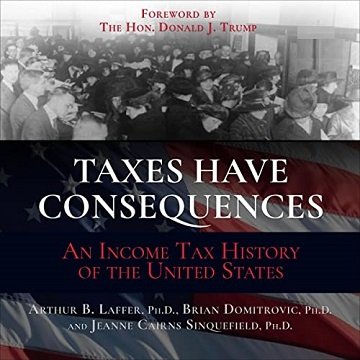

The definitive history of the effect of the income tax on the economy. Ever since 1913, when the United States first imposed the income tax via constitutional amendment, the top rate of that tax has determined the fate of the American economy. When the top rate has been high, as in the late 1910s, the 1930s, 1940s, 1950s, and 1970s, the response of those with money and capital has been to curtail real economic activity in favor of protecting assets and income streams. Huge declines have come to the economy in these circumstances. The most brutal example was the Great Depression itself. When the top tax rate has been cut and held at reduced levels-as in the 1920s, the 1960s, in the long boom of the 1980s and 1990s, and briefly in the late 2010s-astonishing reversals have occurred. The rich have brought their money out of hiding and put it to work in the economy. The huge swings in the American economy since 1913 have had an inverse relationship to income tax rates.

Recommend Download Link Hight Speed | Please Say Thanks Keep Topic Live

Links are Interchangeable - No Password - Single Extraction